Call for Seminar Track Speakers: Share Your Expertise

We invite experienced professionals, thought leaders, and subject matter experts to apply to become seminar track speakers at the PFPA Annual Conference. This is your opportunity to contribute

to the conference's success by sharing your knowledge and insights with our diverse audience of financial and legal professionals.

KEYNOTE SPEAKER

Dr. Shou-Wu Zhang

Fellow of the American Academy of Arts and Sciences, and Fellow of the American Mathematical Society

Professor at Princeton University

Topic : Topic in Mathematics

Professor Shou-Wu Zhang is a distinguished mathematician and a Professor at Princeton University, currently holding the Eugene Higgins Professorship. He is a Fellow of both the American Academy of Arts and Sciences and the American Mathematical Society. Renowned for his profound contributions to number theory and arithmetic geometry, Professor Zhang has worked on influential problems such as the Bogomolov conjecture and extensions of the Gross–Zagier formula. His academic achievements have earned him numerous honors, including the Sloan Research Fellowship, the Morningside Gold Medal in Mathematics, a Clay Prize Fellowship, and a Guggenheim Fellowship. His work continues to shape modern mathematical thought at the highest level.

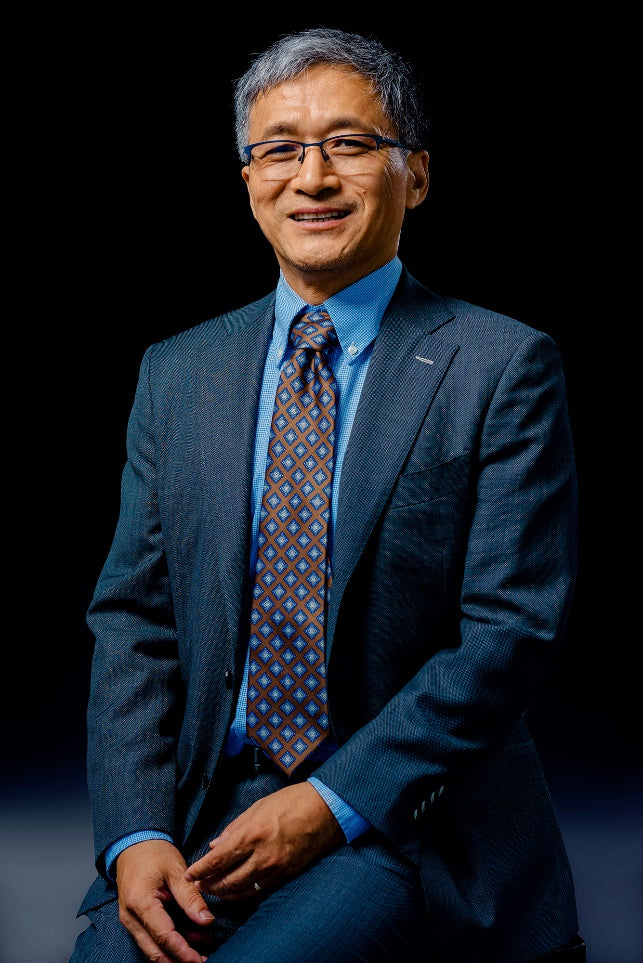

Dr. Yang Wang

Vice-President and Pro-Vice-Chancellor of The University of Hong Kong (HKU), Chair Professor

Topic : Stablecoins and the Hegemony of the U.S. Dollar

Professor Wang Yang serves as the Vice-President and Pro-Vice-Chancellor (Institutional Advancement) of The University of Hong Kong (HKU), where he is also a Chair Professor. He holds a PhD in Mathematics from Harvard University and a Bachelor's degree from the University of Science and Technology of China. Professor Wang is a globally respected scholar with over 150 publications in pure and applied mathematics, covering areas such as data science, machine learning, fractal geometry, and signal processing. Before joining HKU, he held several key leadership roles at HKUST, including Head of the Department of Mathematics, Dean of the School of Science, and Vice-President. He also played a pivotal role in founding the HKUST Big Data Institute and developing innovative academic programs such as the MSc in Big Data Technology.

Yigang Yang

Founder and Managing Partner of WaterStar Capital,

a high-tech venture capital firm based in Atlanta

Topic : Venture Capital Investment Trends & Outlook

Yang Yigang is the Founder and Managing Partner of WaterStar Capital, a high-tech venture capital firm based in Atlanta. Since relocating from Seattle in 2019, he has led three venture funds investing in 15 U.S. and Canadian technology startups.

With over 30 years of experience in North American, Greater China, and global capital markets, Mr. Yang has established WaterStar Capital’s patent-driven investment strategy focused on North American high-tech startups.

He has served on the boards of LumiThera Inc., KitoTech Medical Inc., and Australia’s listed Buderim Group Limited.

Before founding WaterStar Capital in 2016, Mr. Yang was CEO of COFCO Agricultural Industrial Investment Fund, Asia’s largest agribusiness and food investment fund. In 2009, he served as President of Tianjin Yanshan Capital, creating China’s first leasing industry fund, and was a board member of Tianjin Bohai Leasing Co., Ltd.

Earlier in his career, he was Managing Director at Asia Capital Group (New York), Vice President at Credit Suisse First Boston (New York), and Chief Credit Officer at Credit Suisse (Beijing).

Benli HU

Former world bank CTO; Chair of IIADMS (International Institute for Advanced Data Management Study,

www.iiadms.com), Founder and former Chair of DAMA China, both are non-profit data management professional organizations registered in SAR Hong Kong.

Topics: Opportunities and Challenges for New Multilateral Development Agencies: Insights from the NDB

Mr. Hu is the former Chief Technology Officer at the World Bank, where he led global data and IT systems. He also served as Chief Information Officer at Hong Kong’s Securities and Futures Commission, and as Commissioner at the China Securities Regulatory Commission.

His recent work focuses on “Human and Data”—bringing human understanding into data and improving how information connects across disciplines.

Mr. Hu holds degrees in Physics and Computer Science, studied Biophysics, and completed executive programs with Harvard, Stanford, and INSEAD.

James Jin

President & CEO, Chairman, General Mortgage Capital Corp, GMCC is one of the fastest growing independent mortgage bankers /direct lenders licensed in 49 states with HQ in the state of California.

Topic: AI in Lending

General Mortgage Capital Corporation (GMCC) is a nationwide direct lender and

mortgage banker/broker, licensed in 49 states and headquartered in Burlingame,

California. With a strong foundation and a forward-thinking approach, GMCC is

constantly expanding both its program offerings and branch network to serve clients

across the U.S.

GMCC combines deep industry expertise with powerful programs and competitive

pricing—delivering high-quality mortgage solutions nationwide.

SEMINAR TRACK SPEAKERS

FINANCIAL ACADEMIC WITH FINTECH FOCUS

-

Dr. Xiaoming Huo

Professor at Georgia Tech and Associate Director for Research in the Institute for Data Science and Engineering (IDEaS).

Topic: Statistical Computing and Algorithm

Xiaoming Huo is an A. Russell Chandler III Professor in the School of Industrial and Systems Engineering at Georgia Tech and Associate Director for Research in the Institute for Data Science and Engineering (IDEaS). He represented China in the 30th International Mathematical Olympiad (IMO) in 1989, and received a golden prize.

-

Benli Hu

Former world bank CTO; Chair of IIADMS (International Institute for Advanced Data Management Study,

www.iiadms.com)Topic: Collaboration and Interoperability of on-chain and off-chain data in blockchain data management

Mr. Hu is the former CTO of the World Bank and former CIO of Hong Kong’s Securities and Futures Commission. He also served as a Commissioner at the China Securities Regulatory Commission. He currently chairs IIADMS and founded DAMA China, both nonprofit data management organizations. His work focuses on “Human and Data,” exploring how human insight improves data understanding. He holds degrees in Physics and Computer Science and completed executive programs at Harvard, Stanford, and INSEAD.

COMMUNITY INVESTMENT OPPORTUNITIES

-

Dr. Bob Chien

Dr. Bob Chien is a founding member and the head of ecosystem development- Galxe,

Topic: Seeking Stability amidst chaos: From technology arbitrage to stable returns

the largest credential data network in web3. He is an experienced crypto executives and led 2 projects to go public and both hit billion dollars valuation. An investment partner of Evernew Capital & Mentor of 500 startups, and a serial entrepreneur- founded 2 tech companies and exited successfully.

-

Rose Jarboe

Chief Executive Office of Wepartner Group

Topic: The Real Deal: How WePartner Wins in Today’s Market

Rose Jarboe is CEO and Co-Founder of WePartner Group with over 25 years of experiences in finance and commercial real estate.

WePartner Group is an Atlanta-based, fully integrated real estate investment and management firm specializing in acquiring and managing value-add commercial and residential assets. Since iits nception, WePartner has acquired and operated over $300M AUM (Assets Under Management). -

Dr. Henry Yin

Founder and CEO of Long Faith Capital LLC

Topic: Value investing in the stock market and current market analysis

Dr. Henry Yin is the founder and CEO of Long Faith Capital LLC. With an MBA from University of Chicago, he specializes in US stock research and company valuation. With over ten years of investment experience, achieving excessive annualized returns for US stock funds, and possessing in-depth research on industries such as retail, real estate, e-commerce, healthcare, and software.

INVESTMENT & VENTURE CAPITAL TRACK

-

Dr. David Ye

Dr. David Ye Professor at Duke University | Ex-Chief Risk Officer | Data Science and Quant Finance

Topic: Investment Strategies for an Era of Great Changes Unseen in a

Century

Dr. David Ye has over 25 years of Wall Street experience, David held senior executive positions at major global institutions including Chief Market Risk Officer of PNC, Chief Risk officer for Americas & Global head of Portfolio risk of Nomura, Chief Risk Officer & Global head of Market risk of State Street bank, Chief Risk Officer of Guardian Life. -

Marvin Wentao Ma

Vice President at DAK

Topic: Navigating Today’s M&A Market: What Business Owners Should Expect and How to Prepare ( Panel Discuss)

Marvin Wentao Ma is a Vice President at DAK, specializing in financial analysis, industry research, and the development of strategic financial models and deal materials that maximize client value. He brings both domestic and international experience, having previously worked

at Alnitak Capital Partners in New York with a focus on the TMT sector, as well as at Ping An Group and Cowin Capital in China. Marvin holds a Master of International Affairs from Columbia University, concentrating in International Finance and Economic Policy, and a B.S. in Finance and International Business from Indiana University’s Kelley School of Business. -

Dr. Wen Jiang

Deputy Head of Clearing and Chief Risk Officer of Crypto.com Derivatives North America. Before joining Crypto.com, she was a director for InterContinental Exchange.

Topic: Crypto Currency: Market and Risk Management

Wen Jiang is the SVP, Deputy of Clearing, and CRO at Crypto.com Derivatives North America, where she leads trading product design and the risk management division for the CFTC-regulated exchange and clearing house. She previously spent over 15 years on Wall Street with Citigroup, Credit Suisse, and ICE (NYSE’s parent company), focusing on trading and risk management. Wen holds a PhD in Mathematics and an MS in Electrical & Computer Engineering from Georgia Tech, and is currently an EMBA candidate at Emory University’s Goizueta Business School. -

Yigang Yang

Founder and Managing Partner of WaterStar Capital, a high-tech venture capital firm based in Atlanta. Beijing).

Topic: IP Driven Equity Venture Capital Investment

Yang Yigang is the Founder and Managing Partner of WaterStar Capital, an Atlanta-based high-tech venture capital firm. Since 2019, he has led three venture funds investing in 15 U.S. and Canadian tech startups, built on his 30+ years of experience across North American and Greater China capital markets. Before founding WaterStar in 2016, he served as CEO of COFCO Agricultural Industrial Investment Fund and President of Tianjin Yanshan Capital, where he launched China’s first leasing industry fund. His earlier roles include senior positions at Asia Capital Group in New York and Credit Suisse in New York and Beijing.

-

John Wang

John Wang, Founder and COO of ManageLife

Topic: Pay the rent, but you're owning the home -- Unlock the inevitable

housing decentralization mystery with ManageLife.io

John Wang, Founder and COO of ManageLife.io, has 12 years of commercial real estate development and capital markets experience, managing over $1B in assets and executing $600M+ in multi-state projects. Combining real-estate expertise with blockchain innovation, he leads operations, product execution, and strategic growth to make homeownership faster, smarter, and on-chain. John is a graduate of Peking University and Northwestern University,

leveraging strong global networks to drive his vision. -

Linda Yang

Partner in the Corporate and Tax practice group and Intellectual Property practice group at Burr & Forman

Topic: Navigating Today’s M&A Market: What Business Owners Should Expect and How to Prepare ( Panel Discussion)

Linda Yang is a partner in the Corporate and Tax practice group and Intellectual Property practice group at Burr & Forman. She focuses her practice on all aspects of corporate law, including mergers and acquisitions, joint ventures, private placements, corporate governance, commercial contracts, and financing transactions. With a background in intellectual property law, Linda also handles a variety of software licensing agreements, SAAS agreements, and other technology agreements. She also manages clients’ large global IP portfolios and handles registration, enforcement, and monetization matters relating to

trademarks, both in the U.S. and globally. Linda earned her undergraduate law degree in Beijing, China, and subsequently obtained her J.D. from Vanderbilt University Law School.

TOPICS IN INVESTMENT & FINANCIAL PLANNING TRACK

-

Dr.Jingsong Wu

SVP of Quantitative Research and Portfolio Manager within the Securitized Product Group at Voya Investment Management (previously ING US)

Topic: Fixed Income Investment

Jingsong Wu, Ph.D., CFA, is a SVP of Quantitative Research and Portfolio Manager within the Securitized Product Group at Voya Investment Management (previously ING US). His work focuses on quantitative fixed income trading strategies as well as modeling and investing in securitized products. Prior to joining Voya, he spent eight years at Goldman Sachs (GS) in New York, where he gained experience across multiple business lines, including commodity capital market, Liberty Harbor hedge fund, and GSAM fixed income. Jingsong earned his Ph.D from MIT. -

Michael Wu

Founder of ClearPath Agents

Topic: Demystifying the AI Investment Landscape

Michael Wu began his career as an investment banker at JPMorgan covering financial institutions. He later held senior roles in hedge funds and private equity firms, including Asset Alliance Corporation and Stable Asset Management, where he served as COO/CFO and led operations, finance, M&A, and strategic initiatives. At Asset Alliance, he structured GP stakes acquisitions and helped launch multiple investment funds, a wealth management platform, and a fintech venture. He was also a founding investor in SmartX Advisory, a fintech company where he later joined the team. Most recently, he founded ClearPath Agents, focused on agentic research and AI multi-agent frameworks for the finance sector. -

Catherine Zhang

International Client Advisor and Portfolio Manager at Morgan Stanley

Topic: Investment Topics Moderate

Catherine Zhang is an International Client Advisor and Portfolio Manager at Morgan Stanley Wealth Management, serving global clients with comprehensive investment planning and family office services across cross-border banking, lending, tax, and estate strategies. Before joining Morgan Stanley in 2016, she spent nine years in Investment Banking and Fixed Income Trading at Bank of America Merrill Lynch in New York. Catherine holds an MBA from NYU Stern, a master’s in Operations Research from the University of Florida, and both a master’s and bachelor’s degree in physics from Northwest University in China.

AI & BLOACKHAIN

-

Jonathan King ("JK")

Jonathan King ("JK") is Senior Manager of Investments at Coinbase Ventures,

Topic:Crypto Panel discussion

the corporate venture arm of Coinbase

responsible for investing into early-stage startups that are building the

onchain economy. JK has been investing and advising projects in the crypto

space since 2017, and has 12+ years of functional experience that spans

product, engineering, and corporate strategy. JK is a Georgia Tech Scheller MBA alum and completed his undergraduate studies at Georgia State University. -

Hedy Wang

CEO & Co-Founder of Block Street

Topic: Capturing Alpha in Tokenized Assets

Hedy is a seasoned Wall Street veteran. She previously led portfolios at Point72/Cubist, focusing on alpha design, execution models, and scalable trading infrastructure. She also held senior roles at Capital One, where she helped build the flagship credit card product and its core credit risk engines. She studied at Harvard and was advised by faculty across Harvard Business School, Stanford Engineering, and the National Bureau of Economic Research.

-

Kevin Ren

Principal of CGV Capital

Topic: Crypto Panel discussion

Kevin Ren is a partner of CGV Fund, co-founder of AIFocus Accelerator, and former co-founder of Consensus Lab. He focuses on primary market investments and secondary market asset management, and has led investments in numerous star projects such as Polkadot, Filecoin, Casperlabs, Bitget, AlchemyPay, Bitkeep, Pocket, Graph, and Unisats. He has obtained professional certifications and PMP certifications from multiple securities funds. He has a master's degree from Peking University Guanghua School of Management.

-

John Wang

John Wang, Founder and COO of ManageLife.

Topic: Pay the rent, but you're owning the home -- Unlock the inevitable housing decentralization mystery with ManageLife.io

John Wang, Founder and COO of ManageLife.io, has 12 years of commercial real estate development and capital markets experience, managing over $1B in assets and executing $600M+ in multi-state projects. Combining real-estate expertise with blockchain innovation, he leads operations, product execution, and strategic growth to make homeownership faster, smarter, and on-chain. John is a graduate of Peking University and Northwestern University, leveraging strong global networks to drive his vision. -

Justin Zhang

Justin is the founder of Sparsity

Topic: From Decentralization to Globalization: How Blockchain

Rewrites Finance and Infrastructure

Justin is the founder of Sparsity — an a16z-backed blockchain infrastructure startup specializing in fintech applications. He is also a core contributor to the multi-agent

open-source system MassGen.ai and teaches cryptography part-time at Nanyang Technological University in Singapore. Previously, he built products for 1.5B+ users at Microsoft, Google, Nvidia, and Snap, and is a renowned blockchain security expert with 300+ DeFi attack analyses. He graduated from MIT and Tsinghua University, both in computer science, and is an International Olympiad in Informatics (IOI) gold medalist.

COMMERCIAL BANK

-

Dr. Min Wu

Associate Director at Protiviti

Topic : Risk Assessment for Large Language Model and Agentic AI

Min Wu is an Associate Director at Protiviti in the New York office within the Risk & Compliance solution. Prior to Protiviti, Mr. Wu worked for technological firm and private equity firm, focusing on data analysis and valuation analysis. Mr. Wu earned his Ph.D. in mathematics at the University of Washington. Mr. Wu also earned his master’s degree in mathematics at the Tsinghua University, China. Min Wu is a CFA charterholder and a regular member of the CFA Society New York. Min enjoys golfing and skiing, and currently lives in New York City.

-

Keqi Yan

Managing Director of Amarsoft

Topic: Double LLM framework: Intelligent lending risk control through cross-modeling decision.

Keqi Yan is a Managing Director of Amarsoft, she drives global expansion and the delivery of advanced risk modeling solutions at Amarsoft Information & Technology. With over a decade of executive experience across international investment banks, major technology firms, and FinTech startups, her background is extensive. Highlights include directing stringent stress testing frameworks at Credit Suisse to support CCAR compliance, and spearheading global risk management solutions at SAS that were adopted by over 300 banks worldwide.

-

Rufei Qian

CEO of NihaoPay

Topic: FinTech Cross-border payment solution

Rufei Qian brings extensive experience in finance, payments, and fintech, having launched and grown multiple businesses across industries. She currently serves

As CEO of NihaoPay, scaling the company from a startup into a leading provider

of cross-border and omni-channel payment solutions, trusted by businesses

worldwide.

TRUST, TAX & LAW

-

Ming Liu

Ming Liu, Manager Partner at JML Partners

Topic: Tax for Business

Ming Liu, Managing Partner at JML Partners LLC, is an accomplished finance professional with deep expertise in financial strategy and tax management. Formerly the CFO of Dezhu US and a Tax Manager at PwC, he also held a senior tax role at Williams Benator & Libby, LLP.

Ming holds a Master’s degree in Public Administration from Georgia State University’s Robinson College of Business and is recognized for his strong analytical skills and strategic insight. At Super Financial Group, he leverages his expertise to help clients achieve their financial goals.

-

Marvin Wentao Ma

Vice President at DAK

Topic: Merger and Acquisitions

Marvin Wentao Ma is a Vice President at DAK, specializing in financial analysis, industry research, and the development of strategic financial models and deal materials that maximize client value. He brings both domestic and international experience, having previously worked at Alnitak Capital Partners in New York with a focus on the TMT sector, as well as at Ping An Group and Cowin Capital in China. Marvin holds a Master of International Affairs from Columbia University, concentrating in International Finance and Economic Policy, and a B.S. in Finance and International Business from Indiana University’s Kelley School of Business.

Real Estate Track

-

Shawna Li

Director Manager of Mickinley Real Estate Fund

Topic: Private Equity Fund in Real Estate & Risk Analysis

Shawna graduated from the School of Economics at Peking University and previously taught at its Guanghua School of Management. With over 20 years of experience in the U.S. at institutions such as Chase, Wells Fargo, and Truist, she is known for her rigorous approach to risk management and asset allocation. She is currently a fund manager at McKinley Real Estate Income Fund, overseeing more than USD 400 million in assets and leading multiple large-scale real estate projects. Her funds have consistently outperformed industry averages and are recognized as a benchmark for stable, reliable investment within the Chinese community in mainstream U.S. finance. -

Eric Xue

CEO, Dezhu US

Topic: Real Estate Investment

Xin “Eric” Xue, CEO of Dezhu. Mr. Xue has more than 20 years’ experience in business and strategy management. Mr. Xue is currently serving as an executive at multiple real estate development firms, and his total portfolio under his management exceeds $200 million. Prior hto is career in real estate, Mr. Xue worked as Vice President of a public national bank, and consulting manager in a ‘Big Four’ firm.

Why Speak at PFPA Annual Conference?

- Showcase your expertise to a targeted audience of professionals.

- Network with industry peers and build valuable connections.

- Contribute to the professional development of attendees.

- Enhance your reputation as a thought leader in your field.

- Receive recognition in conference materials and promotions.

Speaker Requirements

- In-depth knowledge and expertise in the chosen seminar track topic.

- Ability to deliver an engaging and informative 45-minute seminar.

- Willingness to participate in Q&A sessions and engage with attendees.

- Commitment to align with the conference's goals and values.

Community Project Promotion Opportunity

We warmly invite business owners to take part in our Community Project Promotion Opportunity at the 2025 PFPA Annual Conference. This is a unique chance to showcase your business or project to a professional audience of over 1,000 attendees.

Participation is open to all businesses, with a promotion fee of $1,000. Don’t miss this opportunity to gain visibility, build connections, and support community engagement at one of the year’s most anticipated events!

How to Apply